Home /

Expert Answers /

Accounting /

required-information-problem-2-71-lo-2-4-algo-the-following-information-applies-to-the-question-pa144

(Solved): Required information Problem 2-71 (LO 2-4) (Algo) [The following information applies to the question ...

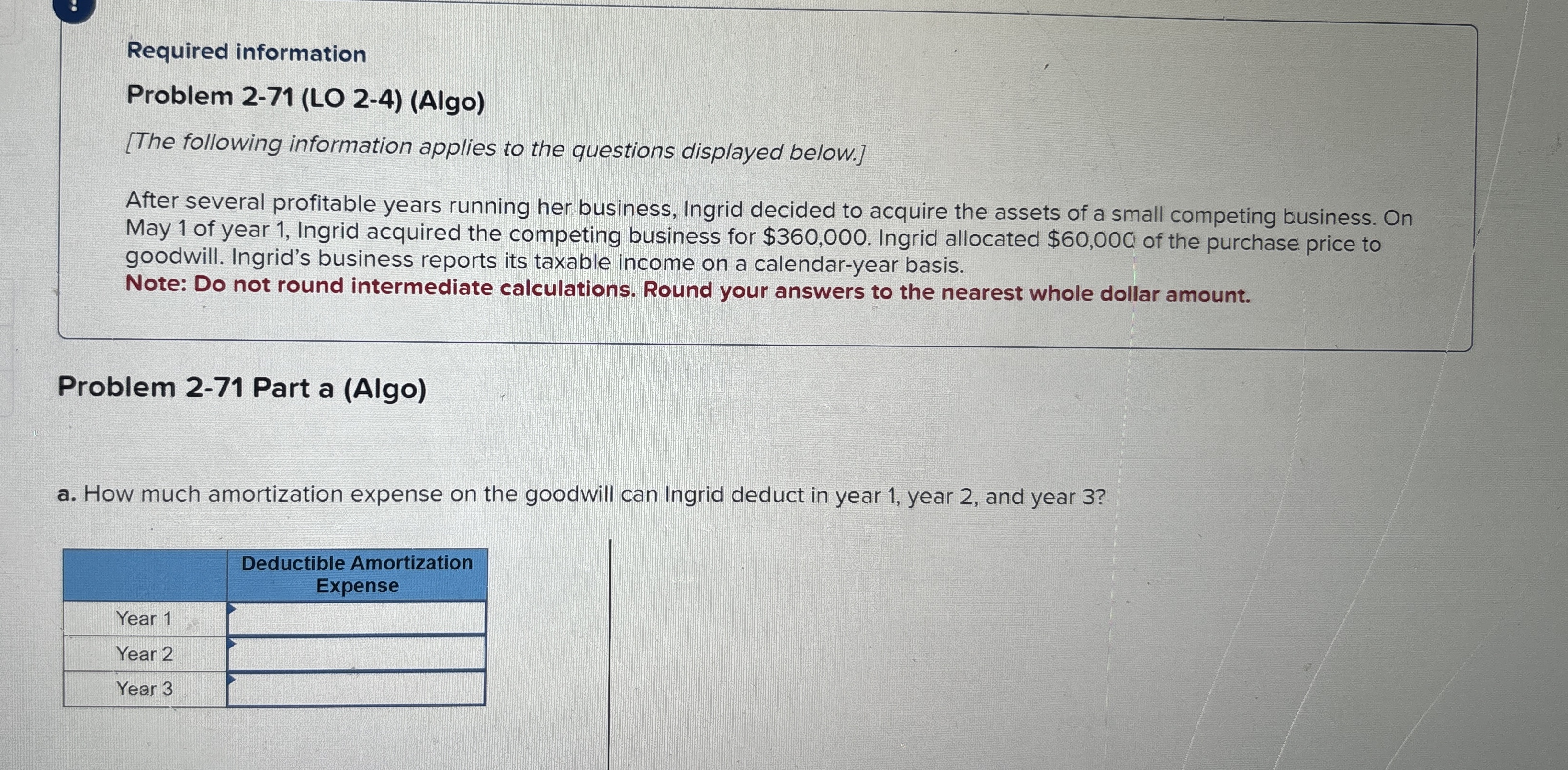

Required information Problem 2-71 (LO 2-4) (Algo) [The following information applies to the questions displayed below.] After several profitable years running her business, Ingrid decided to acquire the assets of a small competing business. On May 1 of year 1, Ingrid acquired the competing business for

$360,000. Ingrid allocated

$60,000of the purchase price to goodwill. Ingrid's business reports its taxable income on a calendar-year basis. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. Problem 2-71 Part a (Algo) a. How much amortization expense on the goodwill can Ingrid deduct in year 1, year 2, and year 3?