(Solved): On June 30, 2024, Plaster, Incorporated, paid $844,000 for 80 percent of Stucco Company's outstandin ...

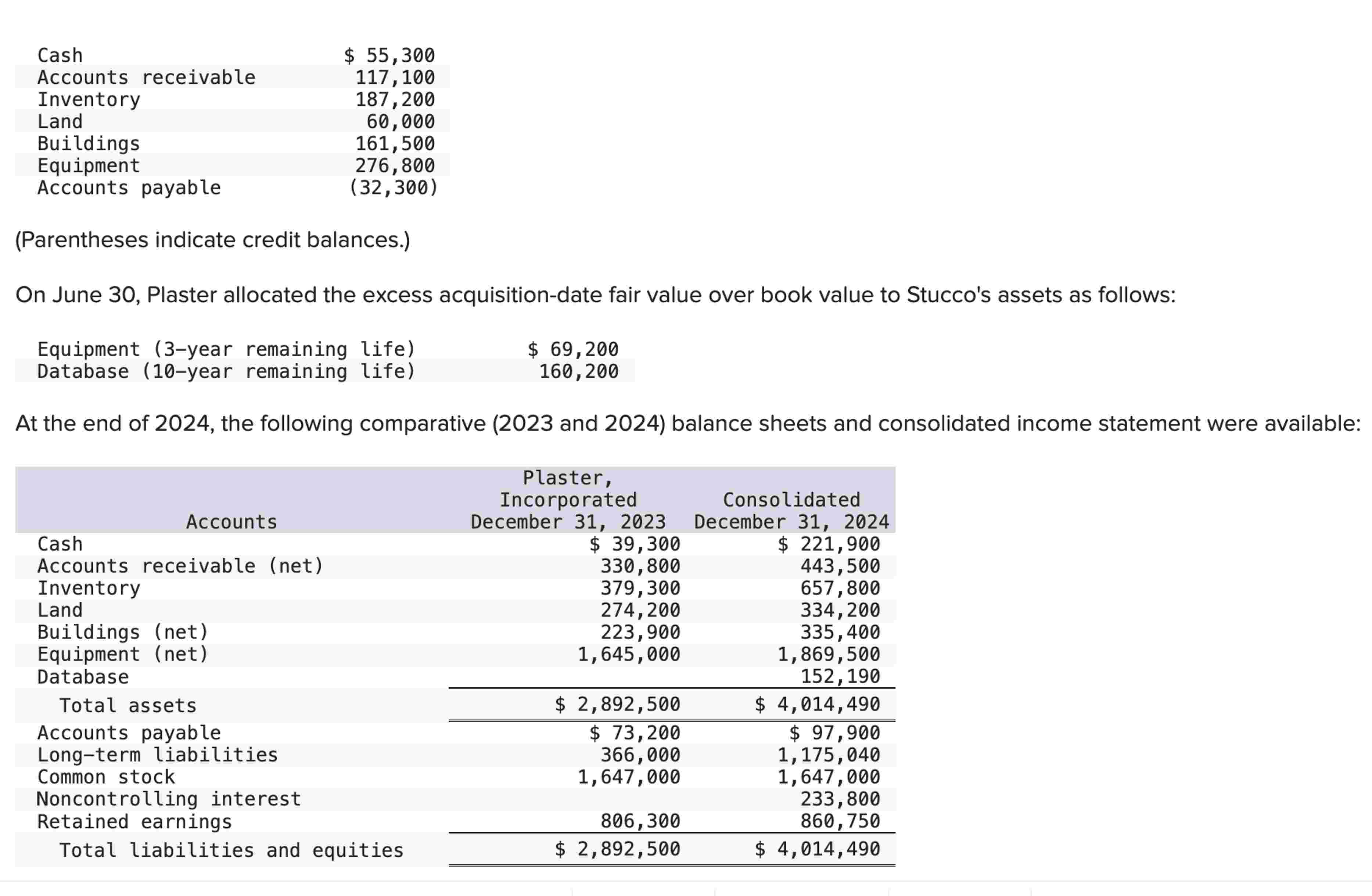

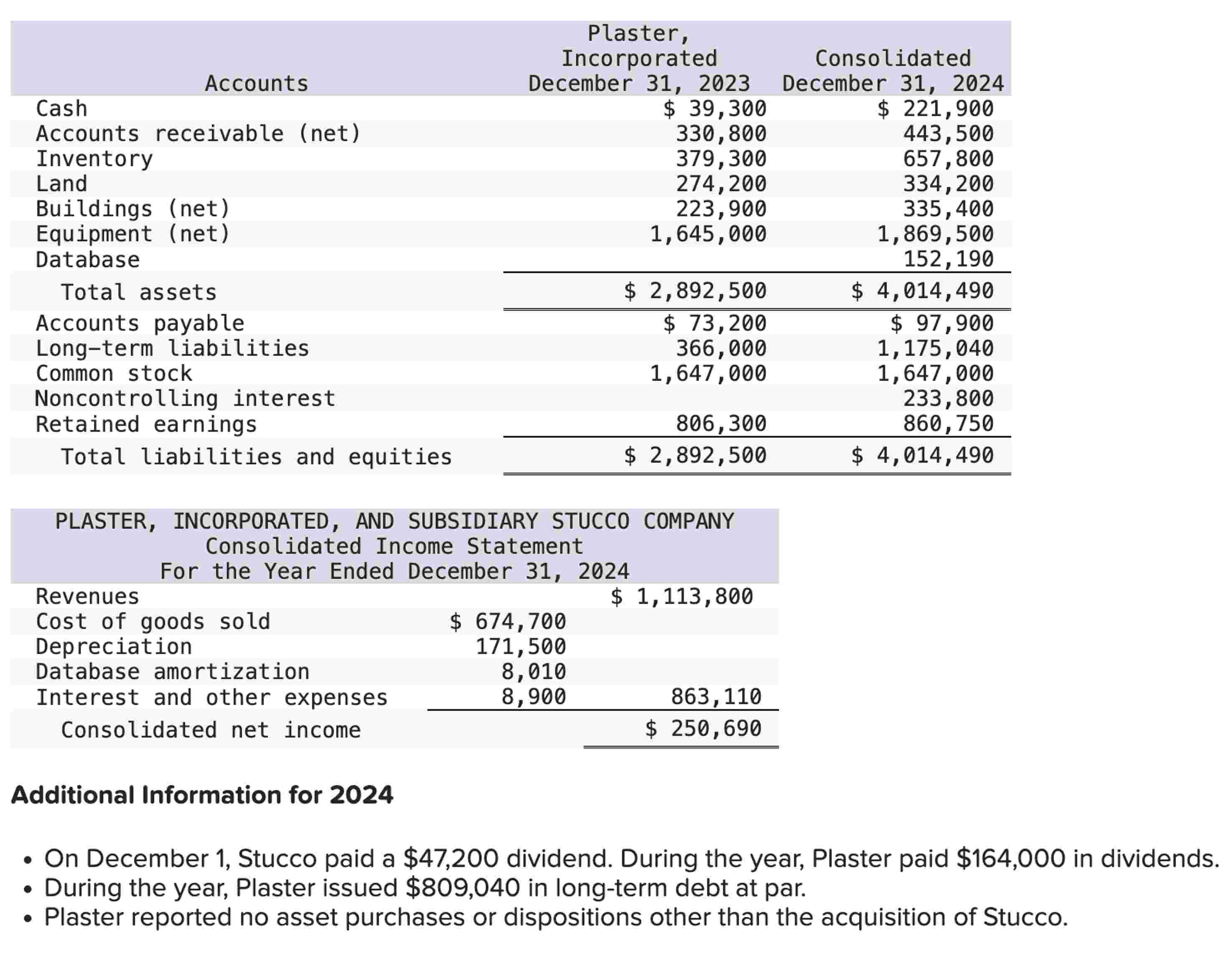

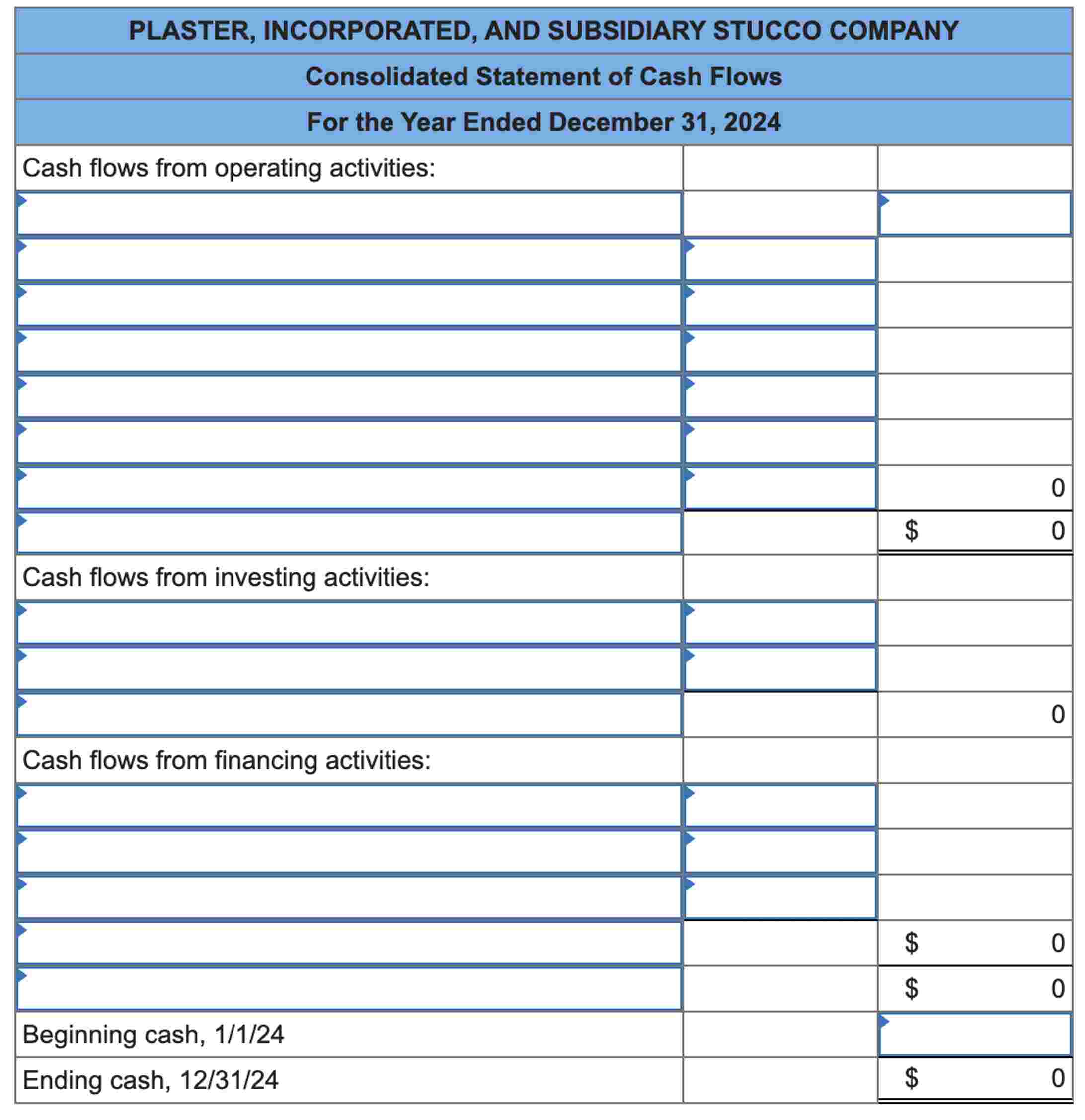

On June 30, 2024, Plaster, Incorporated, paid $844,000 for 80 percent of Stucco Company's outstanding stock. Plaster assessed the acquisition-date fair value of the 20 percent noncontrolling interest at $211,000. At acquisition date, Stucco reported the following book values for its assets and liabilities: Additional Information for 2024 On December 1, Stucco paid a $47,200 dividend. During the year, Plaster paid $164,000 in dividends. During the year, Plaster issued $809,040 in long-term debt at par. Plaster reported no asset purchases or dispositions other than the acquisition of Stucco. Prepare a 2024 consolidated statement of cash flows for Plaster and Stucco. Use the indirect method of reporting cash flows from operating activities