Home /

Expert Answers /

Finance /

as-of-12-31-03-an-insurance-company-has-a-known-obligation-to-pay-4-500-000-on-12-31-pa949

(Solved): As of (12)/(31)()/(03), an insurance company has a known obligation to pay 4,500,000 on (12)/(31)()/ ...

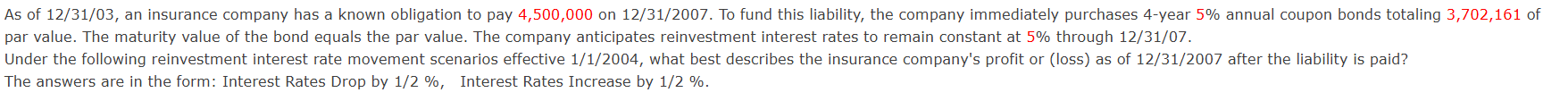

As of (12)/(31)()/(03), an insurance company has a known obligation to pay 4,500,000 on (12)/(31)()/(2007). To fund this liability, the company immediately purchases 4 -year 5% annual coupon bonds totaling 3,702,161 of par value. The maturity value of the bond equals the par value. The company anticipates reinvestment interest rates to remain constant at 5% through (12)/(31)()/(07). Under the following reinvestment interest rate movement scenarios effective (1)/(1)()/(2004), what best describes the insurance company's profit or (loss) as of (12)/(31)()/(2007) after the liability is paid? The answers are in the form: Interest Rates Drop by (1)/(2)%, Interest Rates Increase by (1)/(2)%.