(Solved): A floating rate mortgage loan is made for $200,000 for a 30 -year period at an initial rate of 12 pe ...

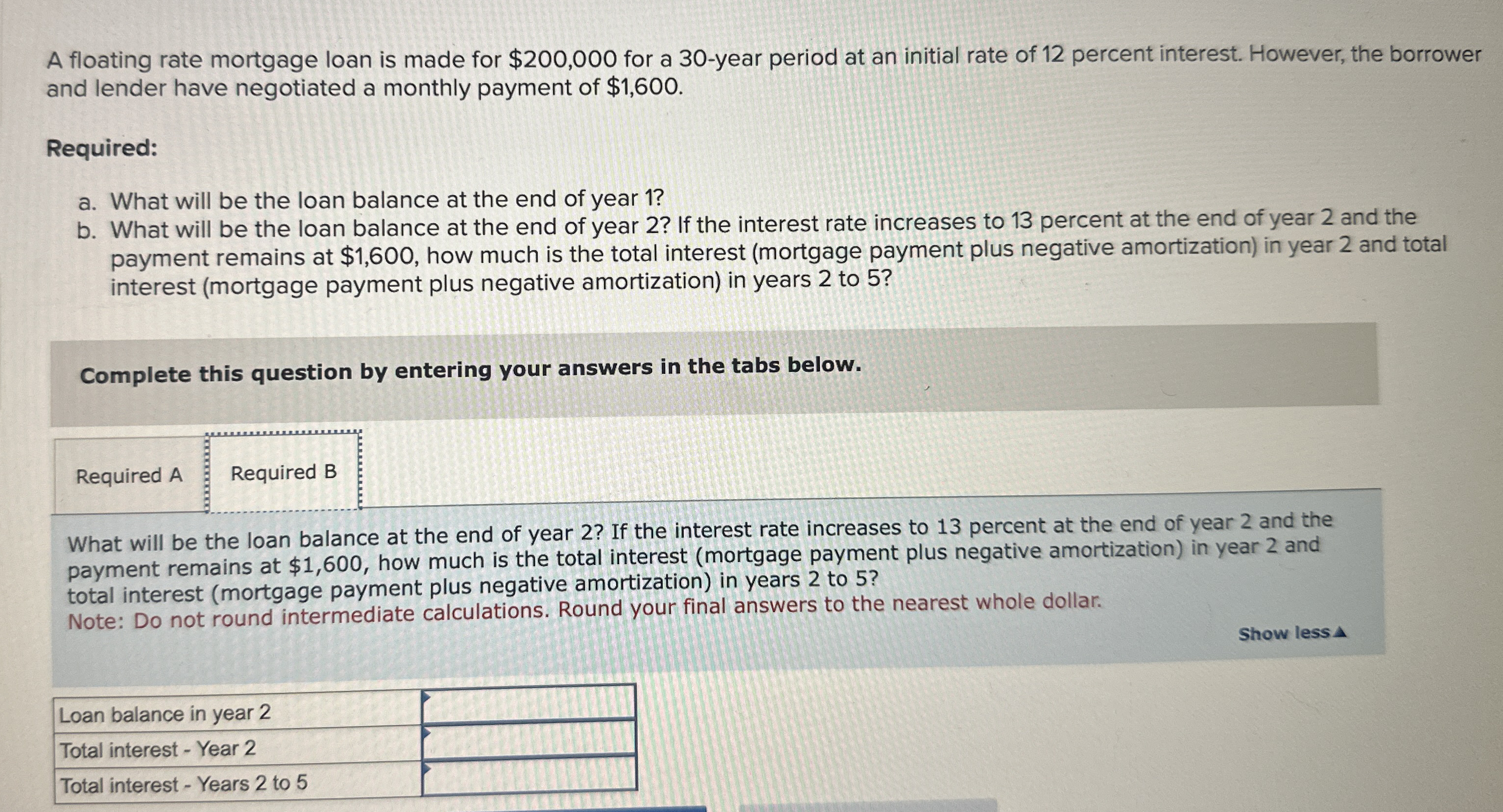

A floating rate mortgage loan is made for

$200,000for a 30 -year period at an initial rate of 12 percent interest. However, the borrower and lender have negotiated a monthly payment of

$1,600. Required: a. What will be the loan balance at the end of year 1 ? b. What will be the loan balance at the end of year 2? If the interest rate increases to 13 percent at the end of year 2 and the payment remains at

$1,600, how much is the total interest (mortgage payment plus negative amortization) in year 2 and total interest (mortgage payment plus negative amortization) in years 2 to 5 ? Complete this question by entering your answers in the tabs below. Required

ARequired B What will be the loan balance at the end of year 2? If the interest rate increases to 13 percent at the end of year 2 and the payment remains at

$1,600, how much is the total interest (mortgage payment plus negative amortization) in year 2 and total interest (mortgage payment plus negative amortization) in years 2 to 5 ? Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Show less Loan balance in year 2 Total interest - Year 2 Total interest - Years 2 to 5